https://asilisacco.coop/impact of covid-19 on saccos in Kenya.

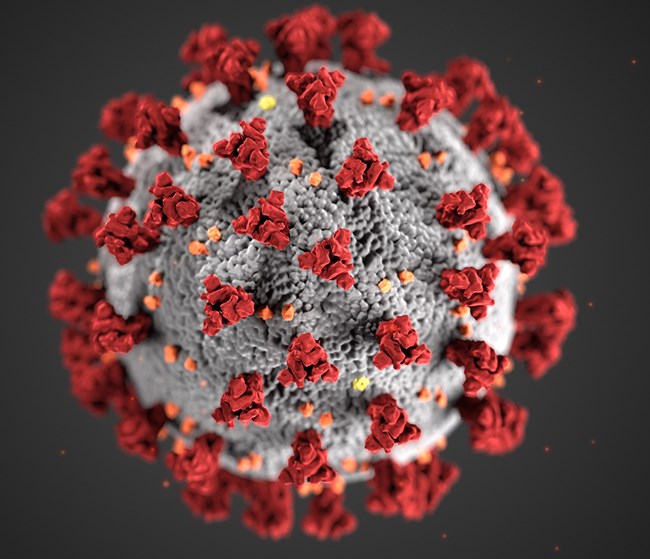

With the spread of Covid-19 in Kenya, safety measures have been recommended by the government to prevent the spread. The Sacco implemented safety measures such as providing hand washing /sanitizing stations for the members and staff. Encouraging everyone to wear masks and keep social distance while visiting the Sacco premises.

Savings and credit cooperatives (Sacco) make up to 45% of Kenya’s Gross Domestic product (GDP). The ministry of CO-OPERATIVE development estimates that 80% of Kenya’s population derives its income either directly or indirectly through CO-OPERATIVE activities. In a recent report by world council of credit unions (WOCCU) Kenya has the largest cooperative movement in Africa and is ranked 7th position globally.

As a result of Covid-19 crisis, many Saccos have experienced reduced number of people visiting the Sacco branches. The pandemic has led to reduced number of members recruited to the saccos, due to social distancing, travel cessation in some counties and corona sickness. Numerous job losses and closure of businesses have been experienced adversely by the horticulture ,hotels and aviation sectors , members of the Saccos from these sectors are unable to make monthly contributions to the saccos. , besides that some Sacco employees were sent home on unpaid leave due to the threat of the pandemic. Staff productivity reduced due to reduce working hours. The pandemic will lead to employee’s redundancy since most Saccos are embracing digital business.

Financially, there is decreased liquidity due to delayed remittance, saving withdrawals to cater for basic business needs and loan defaulting. This has greatly affected the liquidity of the societies besides discouraging the saving culture. There is increase in non-performing loans due to slow business in the country, delayed remittance by the employers and change of repayment terms in line with government directive. The Saccos may fear giving bad loans to none checkoff members because they have no guaranteed income to pay their loans.

Some decisions made in the in the Sacco sector may not reflect the will of the majority of members because the Annual general meeting/annual delegates meetings were postponed .This may lead to poor decisions hence mismanagement of Sacco funds .Unplanned expenditure in line with WHO requirements( face masks ,sanitizers ,water bill etc.) was experienced by many Sacco s.

The Saccos should use this time of disruption to consider reinventing themselves inside out. Some Sacco’s such as ASILI SACCO has seen increased number of its membership using the mobile application known as M-ASILI to do various transactions such as withdrawal, fund transfer to other accounts or to other members, deposits, and utility payment. The loan application has been digitized as well with the help of Microsoft Navision as the core banking system. The Sacco has a member’s portal on the website which assist members to view their statement as well as applying different loans online. With this digitization in some Saccos, the members will be safe from corona by going digital. Sacco during this period should ensure they are responsive on social media. It is also a great opportunity for the Saccos to highlight to their customers that they can carry out their mobile banking or bank online and that they can efficiently and effectively use online chat or social media to resolve issues.

#Stay safe

#Wash hands

#Sanitize

#Exercise

#Social distance

#Stay home

SOURCE:Gloria Sum